Coast Capital Savings

Coast Capital Savings, a credit union in British Columbia, Canada, had recently undergone a major rebranding effort aimed at modernizing its offerings. Historically focused on personal banking, the institution sought to expand its corporate banking services to align with its updated brand identity.

During my time as a Digital UX Specialist on the Digital Experience Team, I was the primary designer for Coast Capital's new Corporate Digital Banking Platform (CDBP), serving their 600,000 users Canada-wide. My responsibilities included research, information architecture, wireframing, prototyping, and visual design. Additionally, I ensured platform-wide consistency through documentation of use cases and UI elements, and I spearheaded the switch from Sketch to Figma as our main design tool, including the migration of the entire design system. My team consisted of three UX designers and a UX lead, and together we worked to ensure all digital experiences across web and app channels felt cohesive and user-centric.

Challenge

The existing corporate digital banking platform faced several critical issues:

- Clients couldn't access the platform on mobile devices, limiting its usability for on-the-go business need

- The platform's design was not in line with modern standards, creating friction and inefficiencies.

- Essential features such as bulk payments, real-time transaction updates, and integration with accounting software were absent.

Corporate banking also posed unique challenges compared to personal banking, including:

- The scale of datasets.

- Customization needs.

- The complexity of navigating large amounts of financial data without intuitive design solutions.

Research

To fully understand user needs and pain points, I conducted:

- Stakeholder Interviews: Discussions with product managers revealed the platform's shortcomings and highlighted key priorities: mobile access, a modern user experience, and critical new features like bulk payments and real-time updates.

- Competitive Analysis: Analysis of major Canadian banking platforms highlighted strengths such as intuitive dashboards and robust security features. However, it also exposed a common gap: the lack of customization options to address information overload.

Ideation & Design

The primary goals for the redesign included:

- Scalability: To address diverse client needs.

- Seamless Security Integration: To enhance trust.

- User-Centric Solutions: To reduce cognitive load.

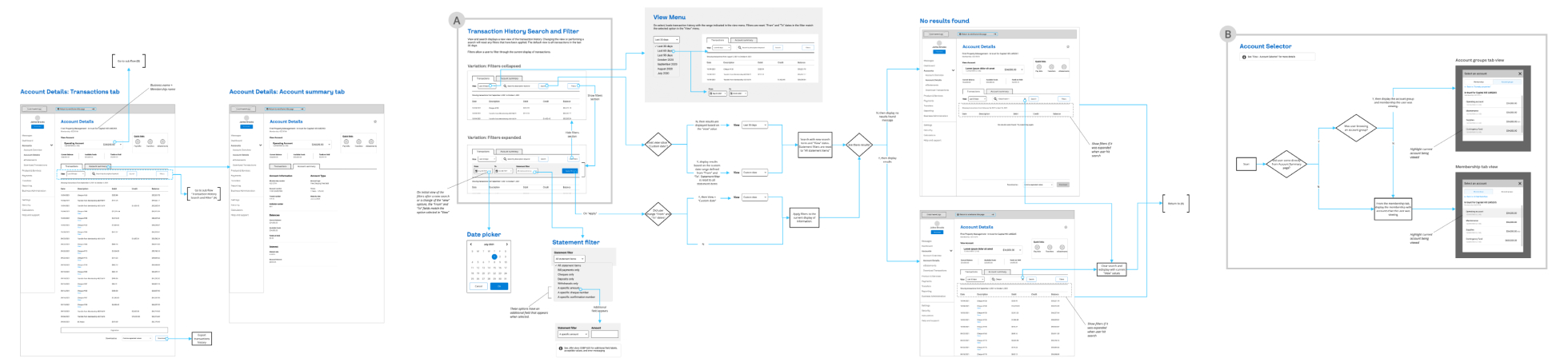

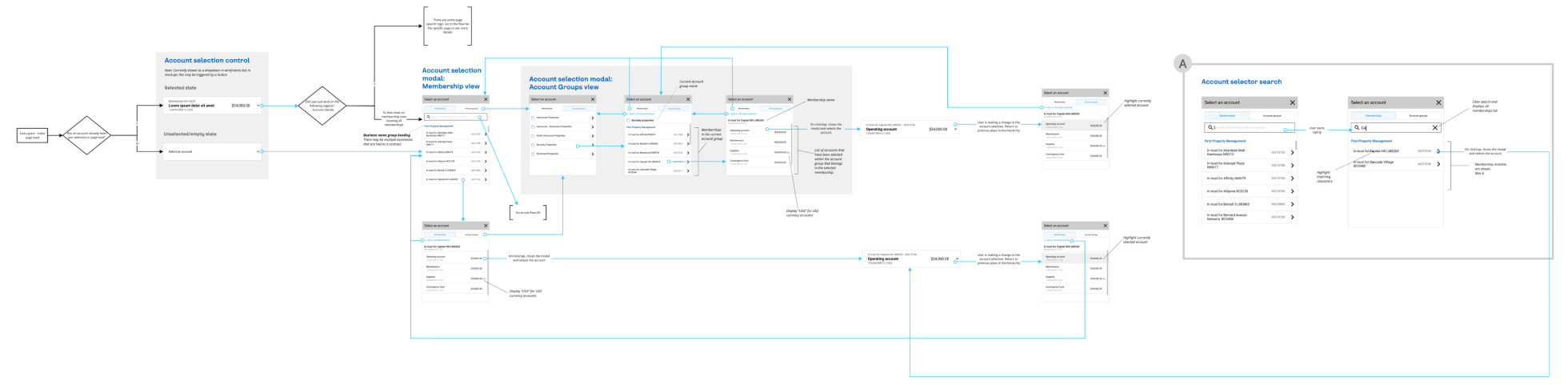

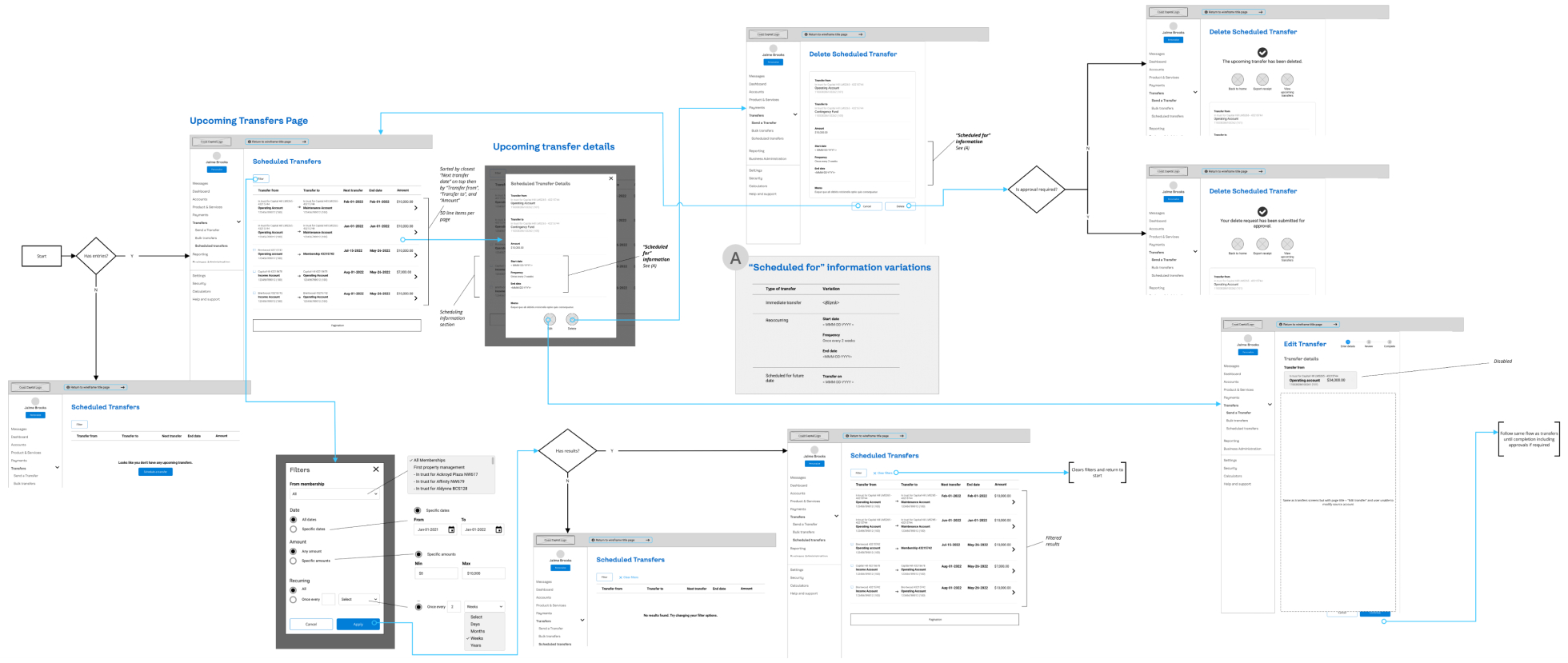

Wireframes were created to visualize the platform's structure and features, such as login, dashboards, and transfer flows. These wireframes facilitated collaboration with product managers and developers, ensuring alignment and iterative improvements.

One example is the redesign of the account selector. The personal banking account selector could not scale for corporate clients managing thousands of accounts. I developed a search-enabled, multi-layered selector that preserved the visual consistency of the personal platform while addressing corporate requirements.

To combat information overload, I introduced “Account Groups.” This customization feature allowed users to cluster accounts based on their criteria (e.g., by location or project), making navigation intuitive and reducing complexity.

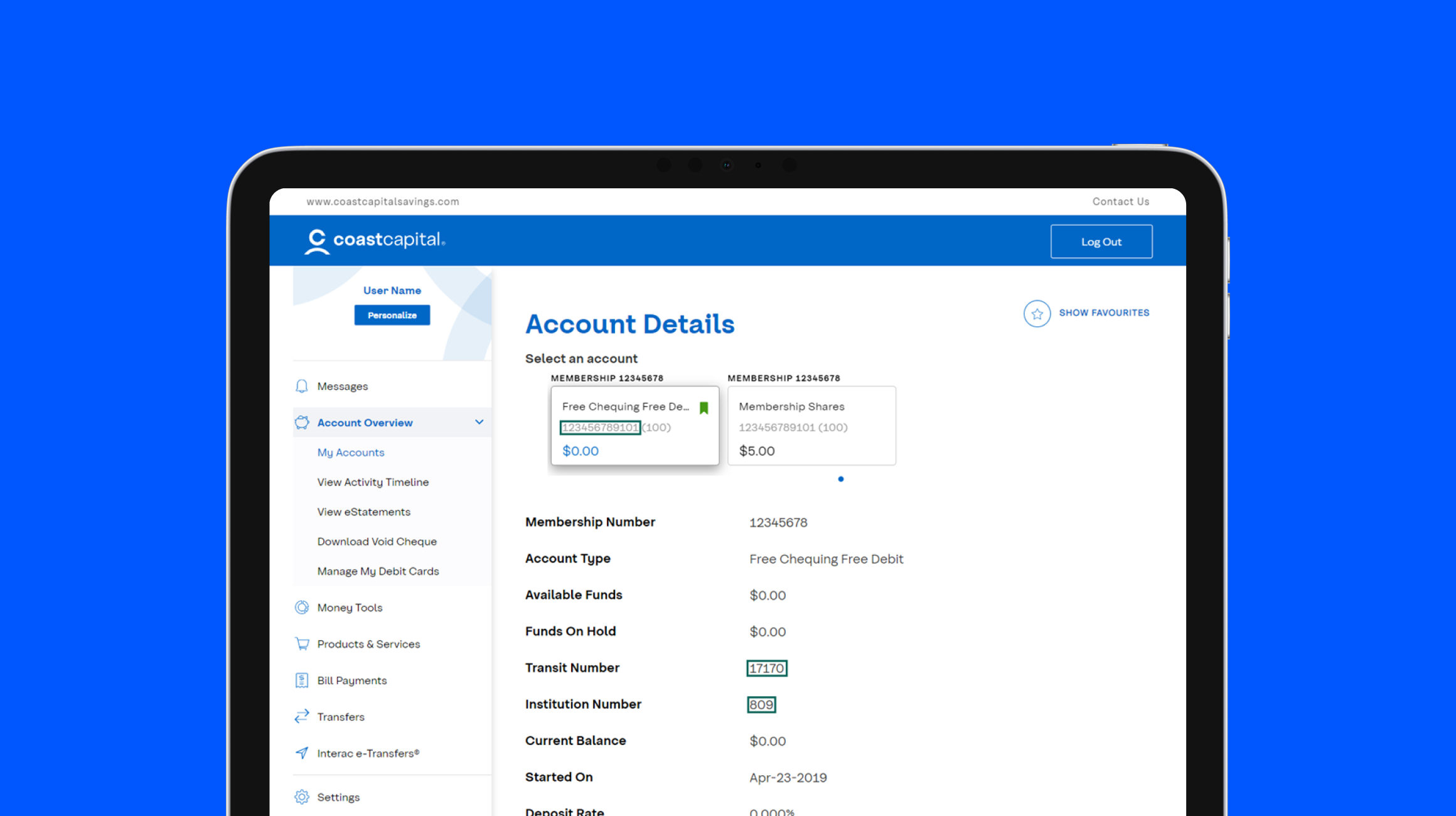

High-Fidelity Prototypes

Using Coast's branding guidelines, I translated wireframes into high-fidelity prototypes that ensured visual and functional consistency with the compan's design system. These prototypes were created, refined, and tested collaboratively with cross-functional teams to align the project vision with technical feasibility and stakeholder goals.

User Testing

We conducted 12 user tests over video, simulating real-world tasks within the platform. My team rotated between facilitating, observing, and note-taking roles, ensuring thorough documentation of insights. The findings revealed:

- Enhanced navigation and mobile responsiveness.

- Security features that reassured users without disrupting workflows.

- Testers praised the intuitive design and seamless functionality across devices.

Outcomes

The platform design successfully addressed the major concerns of the legacy platform while introducing innovative features like “Account Groups” to differentiate it from competitors. Feedback from stakeholders and early client previews at conferences indicated:

- Strong enthusiasm and validation for the redesign.

- Alignment with corporate clients' evolving needs.

- A scalable, cohesive, and modernized platform.

Conclusion

This project exemplified the balance between innovation and brand alignment. By addressing complex corporate banking needs while maintaining a cohesive user experience, the revamped platform set a new standard for digital banking at Coast Capital. Leading this project from research to high-fidelity prototypes provided invaluable experience in user-centered design and collaboration across teams.